How to Invest in Stocks With Adrofx

Investing in the stock market can be a great way to grow capital over the long run. However, it also carries risks and requires research and strategy. One platform that offers tools for trading stocks is Adrofx. This article will provide an overview of Adrofx and steps you can take to get started investing in stocks through their platform.

We'll cover:

- What is Adrofx and how does it work?

- Opening an Adrofx account

- Depositing funds and transferring money

- Understanding stock market basics

- Developing an investing strategy

- Researching and analyzing stocks

- Placing your first stock trade

By the end, you'll have a solid foundation of knowledge to feel confident getting started with stock market investing using the Adrofx platform. Let's begin!

What is Adrofx and How Does it Work?

Adrofx is an online stockbroker that allows individuals to buy and sell stocks, ETFs, options, and other securities online. Some key things to know about Adrofx:

- Available worldwide - You can open an account and trade from anywhere globally as long as you have an internet connection.

- No commissions - Adrofx operates on a spread-only model, so there are no per-trade commissions when you buy or sell assets. They generate revenue from the spread between bid and ask prices.

- User-friendly platform - The Adrofx website and mobile app have intuitive interfaces to make trading easy. Beginners can get comfortable more quickly.

- Research tools - Adrofx provides fundamental data, analytics, news, and educational content right on the platform to help you analyze investments.

- Secure payments - You can fund your account and withdraw profits securely through debit/credit cards or bank wire transfers. Your personal information and money are kept safe using bank-grade encryption.

- Regulation - While an online broker, Adrofx maintains regulatory registrations and follows rules to protect customers. They are not a scam.

Essentially, Adrofx is an all-in-one investment portal where you can manage research, place trades, track your portfolio's performance, and more from any device with an internet connection. Let's look at how to set up your account and get started.

Opening an Adrofx Account

To open an investment account with Adrofx, start by going to (www.adrofx.com) and clicking "Open an Account" at the top. Here are the basic steps:

- Provide personal details - Fill out your name, address, date of birth, etc. You'll need to verify your identity later.

- Choose an account type - Select between an individual or joint brokerage account. Individual is for sole ownership while joint allows two people to share.

- Fund your account - Adrofx requires a $500 minimum deposit to open an account. You can fund the account later, but the money ensures you're a real investor.

- Agree to terms - Review and agree to Adrofx's terms, privacy policy, and risk disclosure explaining the investment risks you are taking.

- Verify your identity - To comply with KYC ("know your customer") laws, Adrofx will ask you to verify your identity. Provide ID documents like a driver's license, passport, or utility bill.

- Account approval - Once verified, Adrofx will review and approve your new account, usually within 1 business day.

- Deposit funds - Transfer money from your bank account into your new Adrofx brokerage account to start investing.

That covers the basic account setup process. Let's look at depositing and transferring money next.

Depositing Funds and Transferring Money

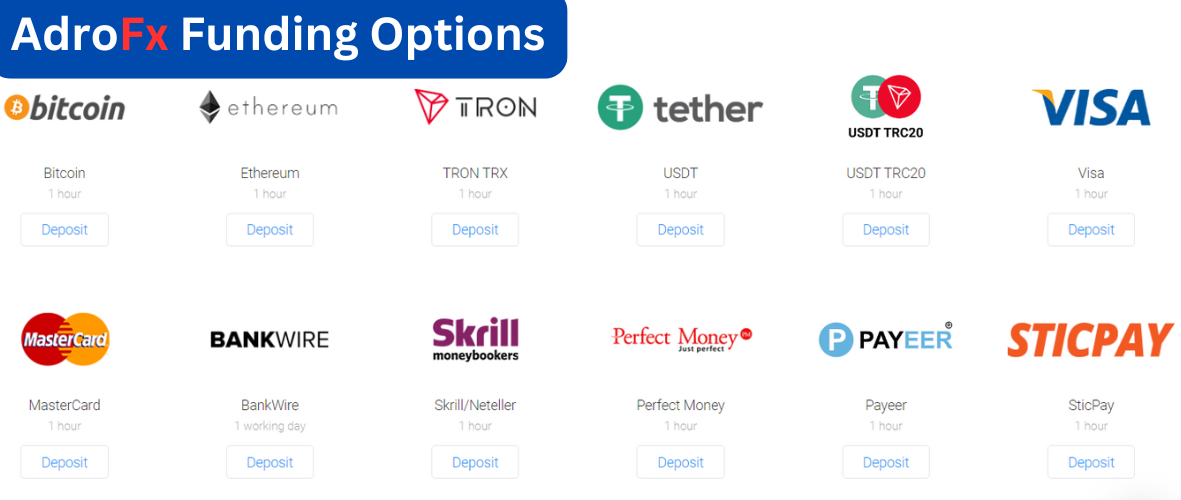

To begin trading stocks, you must first fund your trading account. When you click the "Deposit" button, a variety of deposit options will appear, including bank transfers, credit/debit cards, and e-wallets. To complete the transaction, select your preferred method, enter the amount you wish to deposit, and follow the on-screen instructions. Make sure you understand the minimum deposit and any associated expenses.

With funds deposited into your Adrofx account, you're ready to start researching investment opportunities. But first, let's recap some key stock market basics.

Understanding Stock Market Basics

Even if you're new to investing, it's important to understand some basics about how the stock market works before jumping in:

- Stocks represent partial ownership in publicly traded companies. When you purchase shares, you own a tiny slice of the business.

- Share price fluctuates based on supply and demand as shares are bought and sold on exchanges like the NYSE and Nasdaq.

- Market capitalization refers to a company's total value, calculated by share price multiplied by the number of outstanding shares. Bigger companies have higher market caps.

- Blue chip stocks are from large, well-established companies with a long history of stable growth and dividends like Microsoft, Coca-Cola, and JPMorgan Chase.

- Small-cap stocks are from smaller companies with potentially higher risk but also more upside reward potential if the business takes off.

- Dividends are periodic cash payouts some companies distribute to shareholders from profits. These provide ongoing returns in addition to stock price appreciation.

- Diversification is critical for mitigating risk. You'll want to hold at least 20-30 individual stocks spread across different industries.

Understanding these core concepts will help you evaluate individual investment opportunities and develop a strategic portfolio approach. Let's discuss developing an overall investing strategy next.

Developing an Investing Strategy

Before executing any stock trades, it's important to have a clear strategy in place. Here are some key elements to define:

The first step in developing an effective investment strategy is determining your goals and risk tolerance. You'll want to establish the timelines and expected returns for your investment goals whether you're saving for retirement, a large purchase, or growing long-term wealth. It's also important to understand how much volatility you can withstand in your portfolio - conservatives will hold more bonds while aggressive investors may take on riskier assets like options or penny stocks.

Your strategy also requires determining your asset allocation, positioning style, and rebalancing approach. You'll need to define the percentage of your overall portfolio to allocate to stocks, bonds, cash, and other assets - a typical starting point is 80-90% stocks. You'll also want to focus your strategy on factors like value stocks, growth companies, dividends, or sector-specific plays. It's important to define your position sizing for each investment based on your goals, overall allocation, and the risk/reward profile. Periodically rebalancing your portfolio by selling high and buying low helps maintain your targeted asset allocation as values fluctuate over time - doing so quarterly is a common approach.

With a clear strategy in place tailored to your situation, you'll have guidelines on where to focus your research as well as rules to manage potential emotional decision-making over time.

Researching and Analyzing Stocks

Now it's time to begin researching individual stock ideas to fill your portfolio.

- Screener: Narrow the massive market down to just stocks meeting your customized criteria like industry, P/E ratio, revenue growth, and more.

- Charts: Examine price trends and patterns with interactive charts over various timeframes from daily to max 10 years. Technical analysis helps time entries.

- News/Announcements: Stay on top of the latest press releases, regulatory filings, and media coverage that can influence your outlook.

- Financials: Dive into income statements, balance sheets, cash flows, and key metrics to analyze financial health and performance.

- Analyst Estimates: Measure Wall Street sentiment by comparing projected earnings estimates and price targets over time.

- Company Profile: Learn the business model, competitive positioning, leadership, products/services, and overall investment thesis.

It is advised that you thoroughly examine 10-20 possible assets before deciding on your first few purchases. Create a clear thesis for why each stock might benefit you in the long run. Document all discoveries in an easy-to-reference watchlist.

Placing Your First Stock Trade

Once you've identified promising initial stock picks that align with your strategy, it's time to place a buy order. Here are the basic steps in Adrofx:

- Select "Trade" then "Buy" from the top menu or click a ticker's price on your watchlist.

- Enter the ticker symbol or company name and the number of shares to purchase.

- Review the current share price, commission costs, and total transaction amount.

- Choose a "day" order for the current trading