What is the Difference Between a Forex Broker and an Affiliate?

The forex industry consists of various participants that play distinct yet interconnected roles. While forex brokers and affiliates are both involved in client acquisition and promoting forex brands, there are fundamental differences in their functions, regulations, compensation structures, and relationships with clients. This article explores the key differences between them both in detail to provide clarity on their precise definitions and responsibilities.

What Are Forex Brokers?

A forex broker, also known as a retail forex dealer, is a financial services firm or individual that acts as an intermediary in facilitating forex trading on behalf of clients. Brokers connect traders to the interbank forex market where banks, central banks, and large institutional investors exchange currencies.

Forex brokers take on several key responsibilities in facilitating trading for their clients. They are required to provide a trading platform through which clients can execute orders and trades on various currency pairs. Popular platforms offered include MetaTrader 4/5, cTrader, and Allpips, as well as proprietary platforms developed in-house.

In addition, brokers must quote bids and ask prices for supported currency pairs, obtaining liquidity from providers such as large banks and funds. They also enable various order types like market, limit, stop, and entry/exit orders based on the instructions provided by individual clients. Maintaining client funds in segregated bank accounts as per regulatory requirements is another responsibility to ensure security.

Forex brokers also offer educational resources, market research, signals, and automated trading tools to support their clients. Furthermore, they must comply with stringent Know Your Customer (KYC) norms for identity verification. Finally, brokers subject themselves to oversight by financial regulators such as the FCA, CFTC, and ASIC depending on the jurisdiction in which they operate.

Forex brokers earn revenue primarily through commissions charged on client trades or by adding a markup to the interbank spread that is passed onto clients. Top-tier regulators expect licensed forex brokers to place client interests ahead of profits by maintaining fair pricing and robust risk management standards.

What is A Forex Affiliate?

In contrast, a forex affiliate is an independent third-party entity that promotes and recommends forex brokers and their products or services to prospective clients without directly providing any trading functionalities.

Forex affiliates take on a promotional role within the industry. One of their primary responsibilities involves promoting multiple forex brokers through various marketing programs run across their website and social media channels. This is done to generate and convert new leads or signups on behalf of their broker partners.

Affiliates employ different tactics like educational content creation, software utilization, email campaigns, and other marketing activities to attract potential clients. Their efforts in client referral earn them commissions or performance incentives from brokers, the amounts being dependent on both the number and quality of clients referred. Many affiliates choose to specialize and focus their promotion on certain brokers, particular regions, niche trading products, or specific client profiles.

Unlike brokers, affiliates do not hold any direct control over client accounts or funds. Additionally, as they are not involved in the handling of monetary assets, affiliates operate without requiring financial services licensing. However, they are still expected to follow best practices around ethical search engine optimization and digital content distribution.

Forex affiliates operate on a business-to-business model earning mostly fixed or variable compensation from brokers without bearing traditional compliance, risk, or infrastructure overheads. This allows affiliates high operating flexibility without direct client responsibilities.

Regulatory Status Comparison

A key distinction is the vastly different regulatory requirements for brokers versus affiliates. As entities directly handling client assets, forex brokers are considered financial institutions subject to stringent regulatory oversight by jurisdictions like the FCA, CFTC, ASIC, BaFin, and MAS around the world.

They need to comply with strict capital adequacy norms, client fund segregation rules, systems risk management practices, and maintain mandatory licenses to operate legally. Affiliates on the other hand face a very light-touch or non-existent direct regulation since they do not manage client accounts or money directly. Their role primarily involves marketing and lead generation services for regulated brokers.

Compensation Models

Another major variance lies in compensation models. Forex brokers earn spreads, commissions, or markup on client trades and activities on proprietary trading platforms. Revenue streams directly depend on trade volumes and values generated. Margins here are slim averaging 1-3 pips on standard lots.

On the contrary, affiliates usually receive fixed fees, variable commission payouts, or revenue-sharing percentages from brokers based on the number and quality of referred clients. Payments are based on performance metrics like number of signups, deposits, trading volumes or longevity instead of broker spreads. This uncouples affiliate success from direct client trading activities. Margins are often higher at 20-50% commission on client deposits.

Client Relationships

The final core difference revolves around client relationships. Forex brokers maintain direct relationships with retail traders, providing trading platforms, educational materials, support, and necessary settlement infrastructure to facilitate trading life cycles end to end. They view traders as long-term revenue-generating customers.

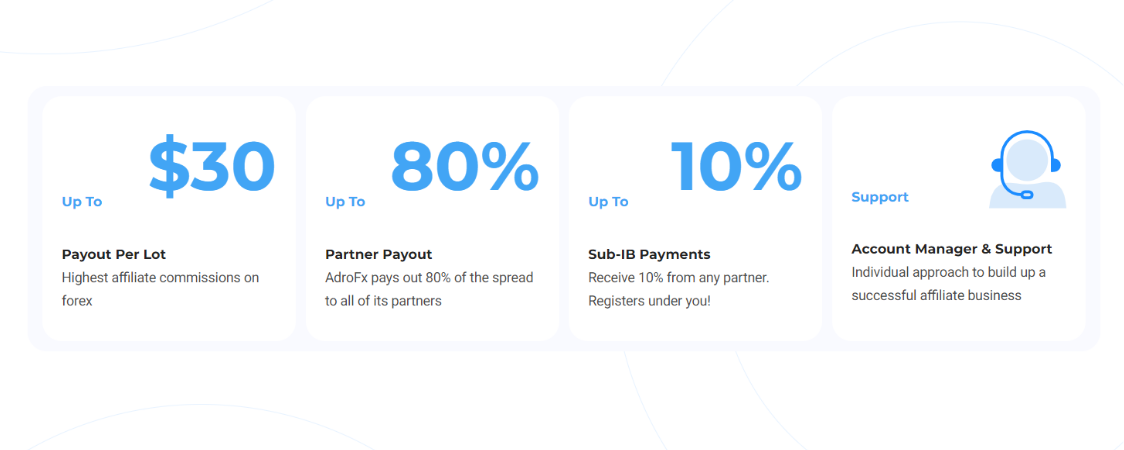

In sharp contrast, once affiliates successfully refer clients to partner brokers, their involvement largely ends. Affiliates outsource direct ongoing client servicing responsibilities to the regulated brokers receiving signups. Affiliates see referred clients more as one-time transactions to earn introduction fees rather than nurturing lifelong clients like brokers do. However, there are some different affiliate plans that vary in the way you are compensated. AdroFx offers its partners three different plans, CPA, Introducing broker, and a hybrid between them.

Compliance Considerations

While affiliates operate independently of direct regulation, working ethically and transparently with licensed regulated brokers remains crucial. Affiliates must disclose their referral status upfront and avoid misleading clients about true roles. Exaggerating broker capabilities, results or oversight can damage reputations.

Furthermore, collecting reviews transparently without manipulation, deceptive comparisons, or unrealistic performance claims protects all parties involved. Affiliating with only properly regulated trusted forex brands provides a safeguard for clients and affiliate businesses alike in the long run.

Conclusion

Forex brokers are regulated financial intermediaries providing full-stack forex trading platforms and services to retail clients, while affiliates are independent marketing partners generating new client introductions for multiple brokers without direct regulatory oversight or customer contact.

Brokers assume long-term client responsibilities with tight controls while affiliates specialize in performance-based client acquisition without ongoing obligations. Understanding how brokers earn through spreads and affiliates through referral fees from different business models equips one to identify their distinct yet interconnected purposes within the global forex marketplace.